Area code Success: The Vital Role of Transaction Processing Agents in Your Business

In today's busy business landscape, the particular ability to course of action payments efficiently plus securely is more crucial than ever before. Since consumer preferences change and digital transactions continue to climb, businesses must adjust to these adjustments to remain reasonably competitive. The Card Association merchant protection is wherever payment processing real estate agents come into have fun with. They are the unsung heroes powering the scenes, facilitating seamless transactions and even making sure businesses could concentrate on what that they do best—serving consumers.

Learning the vital role of the payment processing realtor can unlock brand new avenues for achievement for the business. Through enhancing cash stream to reducing scams and improving customer experiences, specialists provide essential insights in addition to services that can catapult your business frontward. In this write-up, we will check out why partnering with a payment processing real estate agent is not merely beneficial, but important for both small and large enterprises looking to be able to thrive in an ever-evolving market.

The main Position of Payment Handling Agents

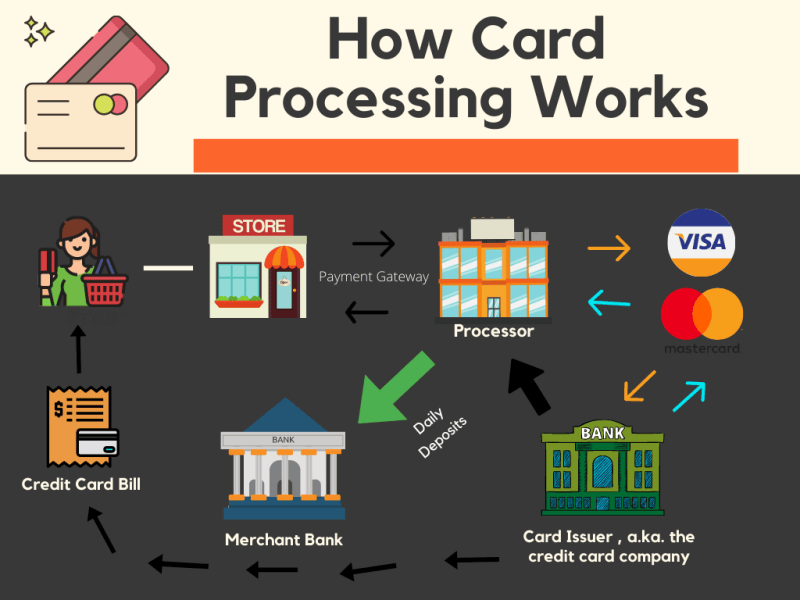

Payment processing providers play a vital role within the modern company landscape by providing as intermediaries involving merchants and payment processors. They make simpler the complexity associated with payment transactions, helping businesses choose typically the right solutions tailored to their specific requirements. By facilitating communication and negotiation using payment processors, brokers ensure that businesses can accept numerous varieties of payments easily and efficiently, which often is crucial regarding maintaining customer satisfaction and loyalty.

In addition to be able to streamlining payment acceptance, payment processing providers offer valuable ideas in the financial aspects of payment running. They help businesses navigate the customarily perplexing landscape of charges, rates, and services agreements, ensuring clear pricing models that will foster trust and long-term relationships. This kind of guidance enables businesses to understand the true costs associated using processing payments, allowing them to produce informed decisions of which can significantly effects their bottom line.

Moreover, transaction processing agents preserve their clients up-to-date on the current trends and systems in the settlement processing industry. As methods of payment progress, including mobile purses and contactless solutions, agents provide education and learning and support to be able to help businesses adapt. By staying ahead of market adjustments, agents empower businesses to enhance their particular payment strategies, in the end driving growth and even improving the general customer experience.

Navigating Settlement Processing Tendencies

As technologies continues to develop, staying informed about payment processing developments is essential for businesses and real estate agents alike. In The Card Association merchant protection , the emphasis may likely be on contactless payments, mobile phone wallets, and typically the integration of man-made intelligence in purchase processing. These improvements not only boost customer convenience but additionally provide businesses along with faster and more secure transaction approaches. Payment processing real estate agents need to adapt and even educate their clientele about these technologies to be able to keep pace with changing consumer anticipation.

Another significant trend is the increasing need for data security within payment processing. With visit this web-site of information breaches and internet threats, customers are really more concerned than ever about precisely how their sensitive data is handled. Transaction processing agents have a crucial role in advising organizations on the best practices for data defense and compliance with regulations like PCI DSS. Agencies that emphasize robust security measures will not really only build confidence with their clientele but also entice clients looking with regard to reliable payment options.

Eventually, the rise associated with e-commerce has reshaped the landscape involving payment processing, making it critical intended for agents to realize online payment techniques and platforms. Since more consumers choose online shopping, businesses must offer soft payment options that will appeal to digital transactions. Payment processing agents can help their clientele navigate the several e-commerce payment solutions available, making sure they will enhance the client experience while lessening transaction costs. Keeping up with these trends, agents may position themselves while valuable partners within their clients' achievement.

Capitalizing on Revenue through Efficient Partnerships

Building strong human relationships with payment control agents can result in considerable revenue growth intended for businesses. These real estate agents possess specialized understanding of the payment scenery, helping businesses find their way complex payment control systems and recognize the best options tailored to their particular needs. By collaborating with agents, organizations can access much better rates and improved services that improve their overall productivity.

Moreover, payment processing brokers bring invaluable ideas into the most recent trends and systems in the market. Their competence allows businesses to stay prior to the competitors by leveraging innovations such as mobile phone payments and contactless transactions. This elasticity not only enhances client satisfaction but in addition drives higher deal volumes, further surrounding to revenue optimization.

Ultimately, effective partnerships along with payment processing real estate agents streamline operations and enhance customer experiences. With their direction, businesses can focus on growth and innovation while ensuring their payment operations are efficient and even secure. The best real estate agent can behave as a new strategic ally, leaving you businesses to open their full revenue potential in a new rapidly evolving marketplace.