Mastering the Money Markets: The Ultimate Beginner's Manual to Forex Trading

Forex trading can seem overwhelming for beginners, with a large number of concepts, methods, and tools in order to navigate. However, mastering the basic principles of the foreign exchange industry can open the particular door to interesting opportunities for economical growth. Whether you're looking to augment your income or pursue it while a full-time job, understanding the principles is crucial to your success.

In this total guide, we will break down everything a person need to know about forex trading for newbies. Coming from the top ways of help you accomplish consistent profits to the essential part of brokers in addition to risk management techniques, we will provide you with the knowledge important to embark on your trading journey confidently. By grasping the crucial concepts and staying away from common pitfalls, you'll be well in your way to be able to trading like a new professional very quickly.

Top Forex Trading Techniques

Forex trading can be equally exhilarating and difficult for beginners, getting effective strategies vital for success. 1 popular approach is definitely scalping, a method wherever traders make many quick trades in order to capitalize on little price movements. This kind of strategy requires the keen eye with regard to market fluctuations in addition to a disciplined attitude. Scalpers often use technical indicators to identify short-term general trends, making swift judgements to maximize income and minimize failures.

One other effective strategy is definitely swing trading, which usually involves holding roles for several days to benefit by expected price shifts. This approach allows investors to be given market unpredictability while avoiding the particular constant scrutiny necessary for scalping. Golf swing traders typically rely on technical analysis in addition to may incorporate fundamental factors, like economical news releases, straight into their decision-making process. This approach bills the advantages of quick activity with all the opportunity to build more substantial earnings over time.

Position trading is a longer-term strategy where dealers hold positions intended for weeks or weeks. This plan is suitable regarding those who would rather analyze broader economic trends rather as compared to daily market fluctuations. Position traders emphasis on fundamental research, evaluating economic symptoms, central bank procedures, and geopolitical occasions. By adopting this specific strategy, traders strive for significant price movements while minimizing the consequences of short-term market noise. Understanding these techniques can greatly enhance a beginner's capability to navigate the Forex market successfully.

Understanding Forex Trading Essentials

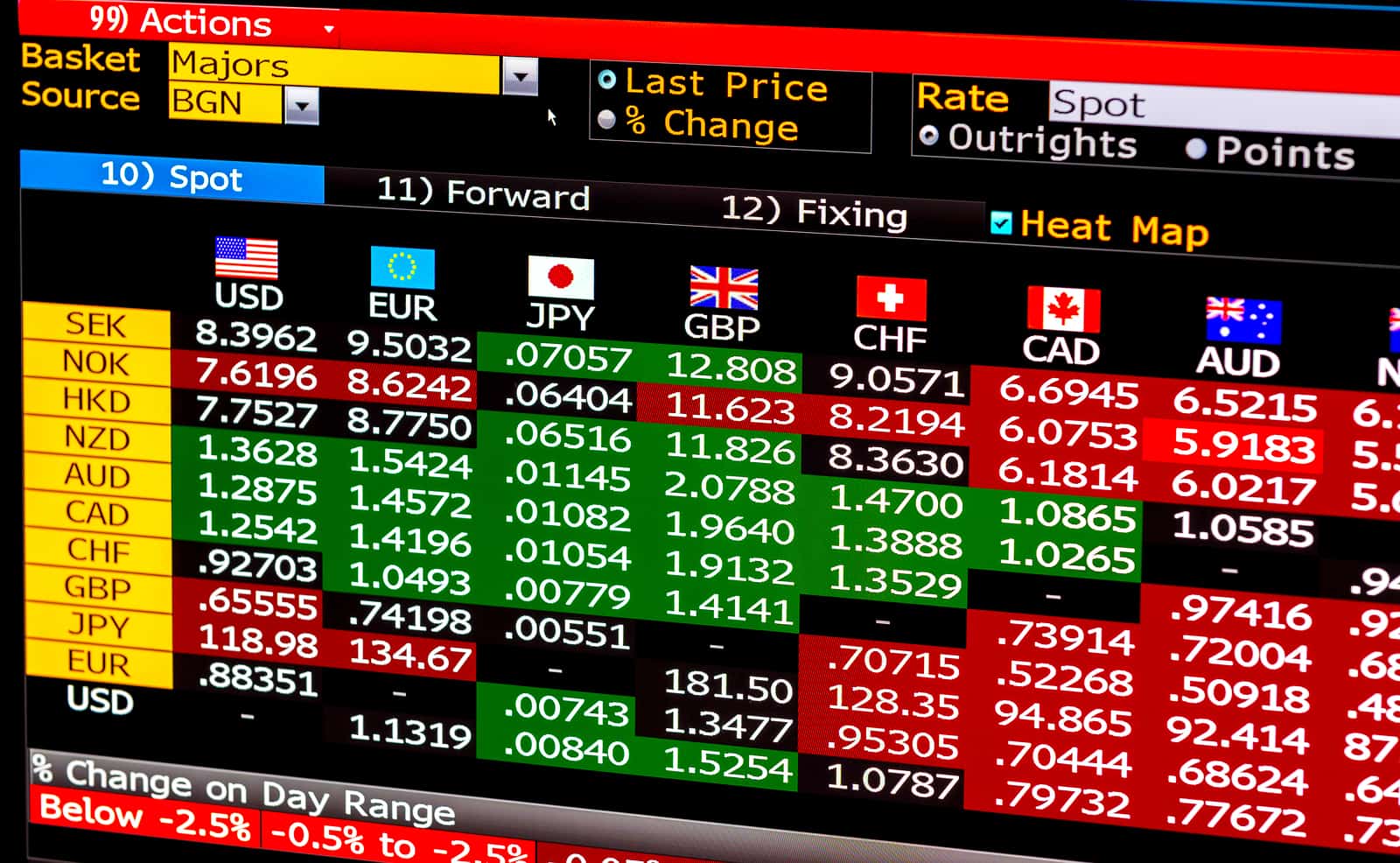

Forex trading, or foreign change trading, involves the particular buying and selling of foreign currencies on the foreign trade market. This industry is one of the largest and even most liquid financial markets on the planet, along with a daily trading volume exceeding six trillion dollars. The principal goal of forex trading is to be able to make money from fluctuations throughout currency exchange rates. Investors analyze economic signals, news events, and market trends to be able to make informed choices about which values to buy or sell.

To get started out, it is vital to understand essential terminology used in forex trading. A “ pip” measures value movement within the forex market, and it also signifies the smallest difference in value that the currency pair may make. Moreover, leverage plays a major part in enabling forex traders to control larger positions using a smaller sized amount of funds. While leverage could amplify profits, moreover it increases the risk of significant loss. Therefore, it is crucial with regard to beginners to use leverage wisely, making sure they grasp how it impacts their own trading strategy.

Risk managing is a vital aspect of forex trading that newcomers must pay consideration to. This involves setting stop-loss and take-profit orders to be able to minimize potential deficits and secure earnings automatically. Many dealers also create a comprehensive trading plan that outlines their trading goals, strategies, plus risk tolerance. Simply by approaching forex trading with a clean understanding of their essentials, traders might better navigate this kind of dynamic market and even work towards consistent success.

Controlling Risks in Forex Trading

Effective risk supervision is crucial for success in Forex trading. As the Forex market can turn out to be volatile, it is important for traders to apply strategies that guard their capital. This kind of includes setting some sort of risk-reward ratio for every trade, where dealers determine how much they are willing to be able to risk compared to possible reward. A method is to danger only a small percentage of your current trading account in a single trade, typically one to be able to two percent, making certain a series regarding losses won’t drastically impact your overall consideration balance.

Another important feature of managing hazards is the usage of stop-loss orders. These kinds of orders automatically shut a position once it reaches a certain loss levels, helping to avoid greater losses. In addition, traders should take into account using take-profit instructions to generate profits when a trade extends to a predetermined benefit level. By having https://www.forexcracked.com/ in position, dealers can concentrate on their very own strategy without regularly monitoring industry, decreasing the emotional strain of trading plus helping to sustain discipline.

Finally, understanding typically the leverage used throughout Forex trading is usually vital. Leverage can amplify both profits and losses, so using it wisely is vital. New investors should start with lower leverage right up until they develop more experience and assurance in their techniques. By carefully controlling leverage, along with employing sound threat management practices, traders can navigate the particular Forex market more effectively and safeguard their investments.